What you see is not what you get

Many investors believe that a fund’s total return is a good indication of future expected returns. The best-performing funds, hence, are expected to deliver the best return for them, and vice versa. But this common practice of projecting a fund’s past performance into the future almost guarantees investors lower returns, as many wind-up chasing funds that have risen considerably only to see prices falling later. History has shown that chasing performance is a sure way to widen the gap between investors’ return and fund/market return.

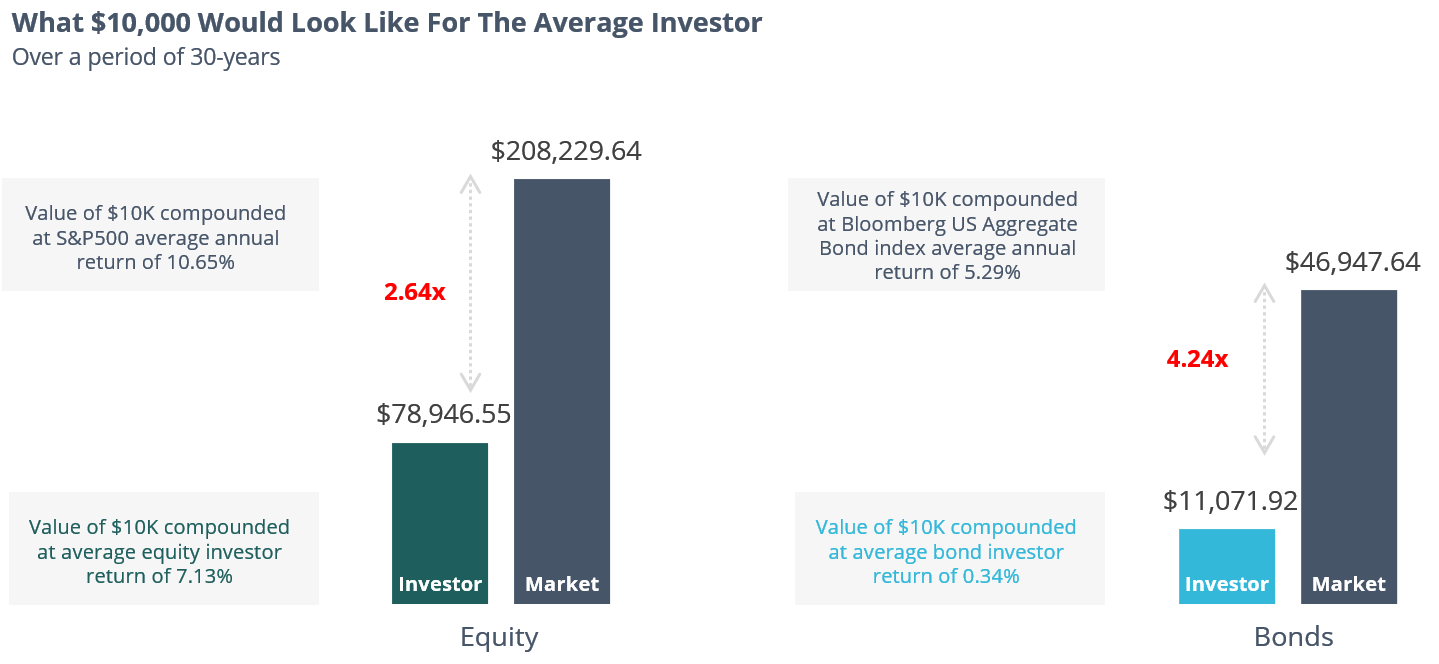

According to research by DALBAR, the average equity and fixed income investor underperforms passive investment solutions by 3.52% and 4.95% respectively. While seemingly ‘insignificant’, they compound into strikingly huge differences. Over a 30 years period, the average investor would have earned 2.64x and 4.24x more if they simply invested in major indices.

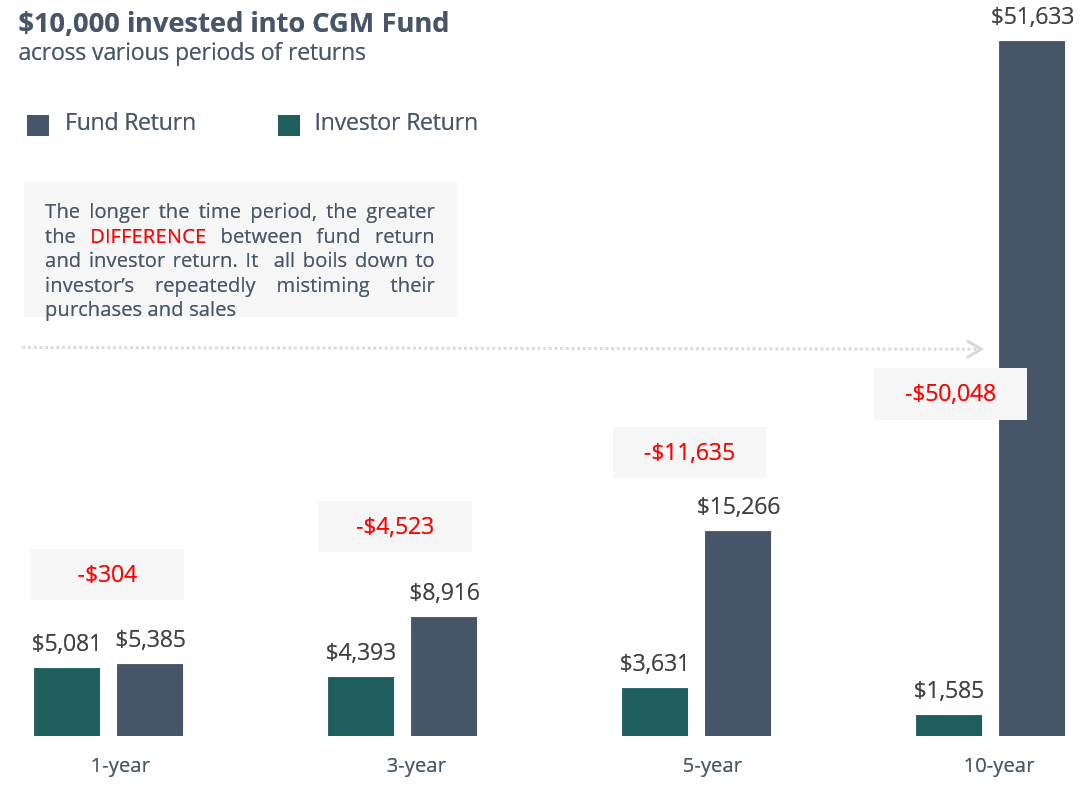

Such glaring underperformance is not limited to the realm of passive investment solutions. It also extends to actively managed funds and is a common phenomenon with high-performing funds. Take the case of CGM Focus Fund, one of the best performing funds from 2000 to 2009. While the fund delivered an impressive 18% per annum, its investors realized -17% per annum, a whopping 35% difference. This suggests that the same $10,000 would shrivel to just $1,585, compared to what would have been worth $51,633.

When Past Performance Kills

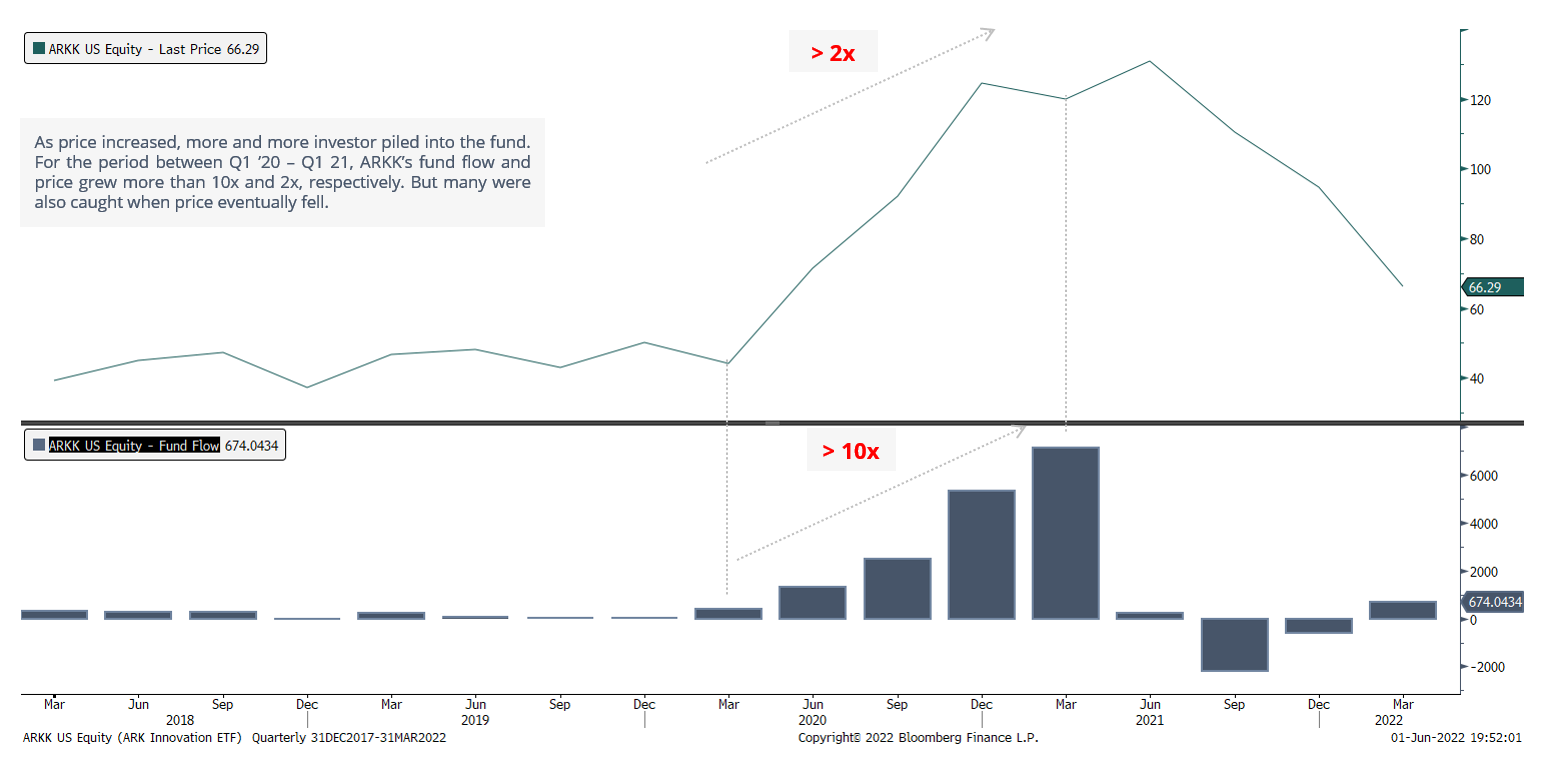

Trying to chase the biggest climbs inevitably leads to poorer investors’ returns. Such is the ramification of inopportunely time purchases and sales of investments that are often associated with performance chasing. Here, we examine this in greater detail using the popular ARK Innovation fund as a case study.

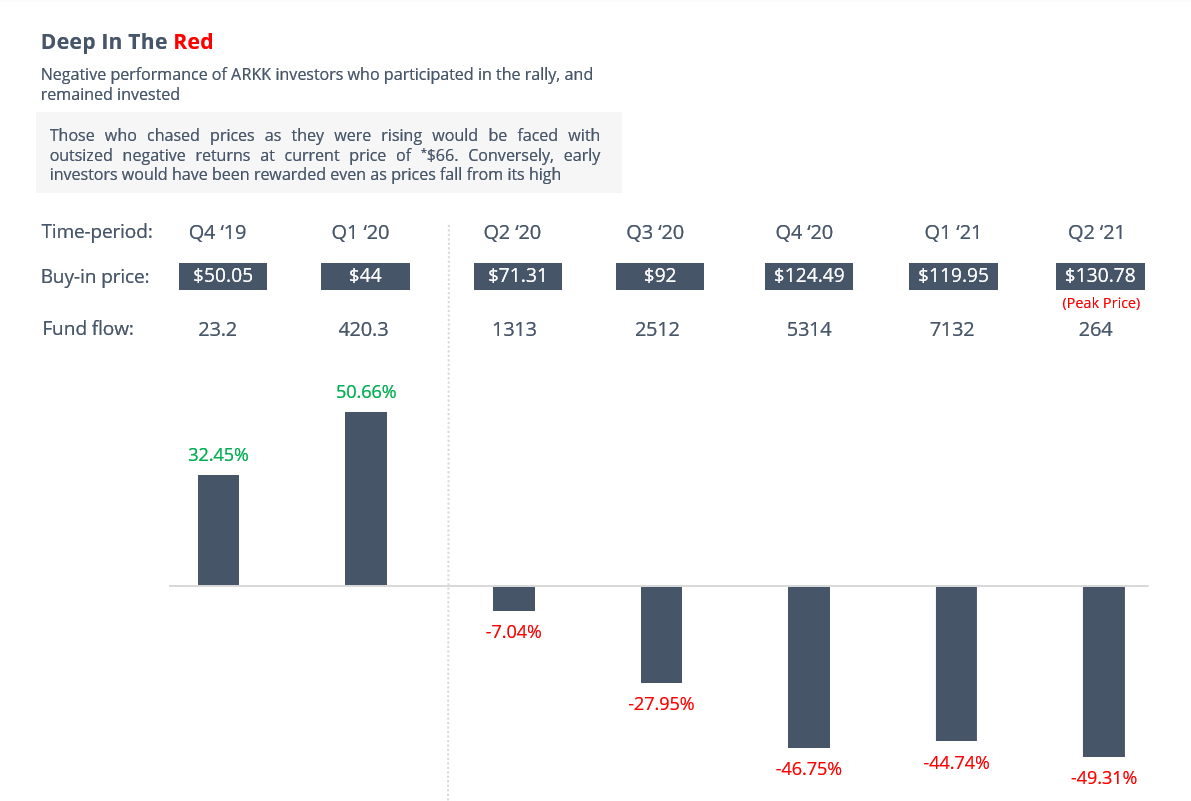

What is clear is that most investors were late to the party. Many chased prices into higher highs and bought in near the top. As the chart below illustrates, most of the fund’s inflows occurred throughout 2020 and early 2021. At its peak, in Q1 2021, fund inflow was more than 10 times the amount at the start of 2020. Unsurprisingly, this was right when the fund’s performance was peaking.

But many were caught by turning tides. Right when investors were most optimistic about higher prices and many more poured in, prices tumbled. From the peak price of $130, in Q2 2022, prices fell by almost 50% to double-digit lows of $66, with considerable net outflows. In fact, many investors who remained in the fund are likely to be disappointed (refer to Deep in the Red chart). Relatively few investors would have benefitted from the rally – they are those who have invested in the fund prior to the run-up in price.

We’re Not Irrational – We’re Human

In fact, such stories are littered throughout history. Many investors unwittingly buy high and sell low in spite of knowing the old investing adage of “buy low, sell high”. This is because our investment decisions are often entwined with emotions (such as greed and fear) that drive our decision-making. In fact, certain aspects of human behavior such as the fight-or-flight response surface as a natural reaction of our human evolutionary adaptation (read more here). Other times, we fall prey to biases (such as hindsight bias and Anchoring bias) that lead us to make counterintuitive decisions that are detrimental to returns.

Bridging The Gap

Having a well thought of investment philosophy can go a long way in steering us away from the ill effects of performance chasing. In the same way that a map ensures drivers make the right turns to arrive at the right place, an investment philosophy is an intractable belief that guides our investment decision-making across market conditions, in both good and difficult times, and ensures that our investments are in line with our values and goals.

In fact, many successful, long-term investors rely on an investment philosophy to stay focused on their investment objective and discipline their investing activities. It is what enables them to remain invested and patient to reap the rewards of their strategy.

Even the world’s most successful investor, Warren Buffet, adheres to an investment philosophy: “Buy wonderful businesses at a fair price with the intention of holding them forever.

For us at Finexis Asset Management, we believe in investing over the long-term and constructing portfolios with better overall performance asymmetry (less downside, more upside). This means heeding our Fundamental, Valuation, and Technical (FVT) process to identify and invest in areas with higher future returns and avoiding those that have already delivered performance. And progressively, selecting the most appropriate strategy that is suited to express our beliefs.

In principle, what is your investment philosophy? If you haven’t got one, now is the time to act and bridge the gap between your performance and the fund’s performance.