1.

1. A Smoother Ride

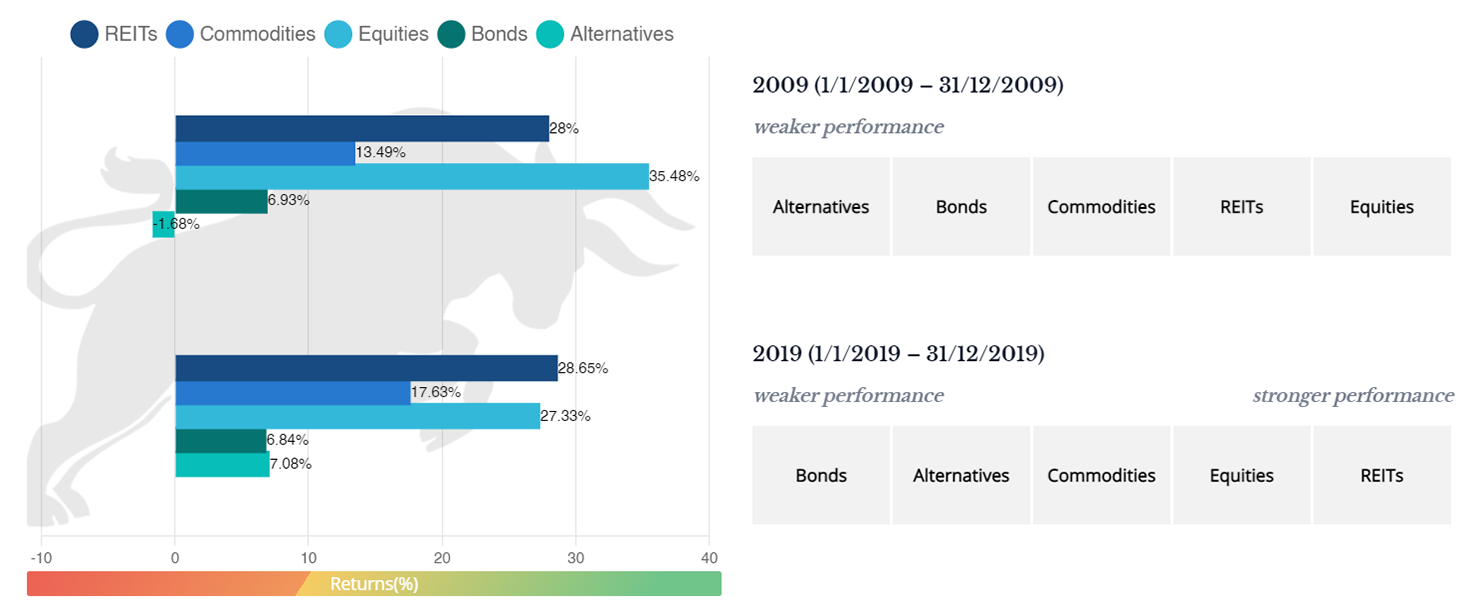

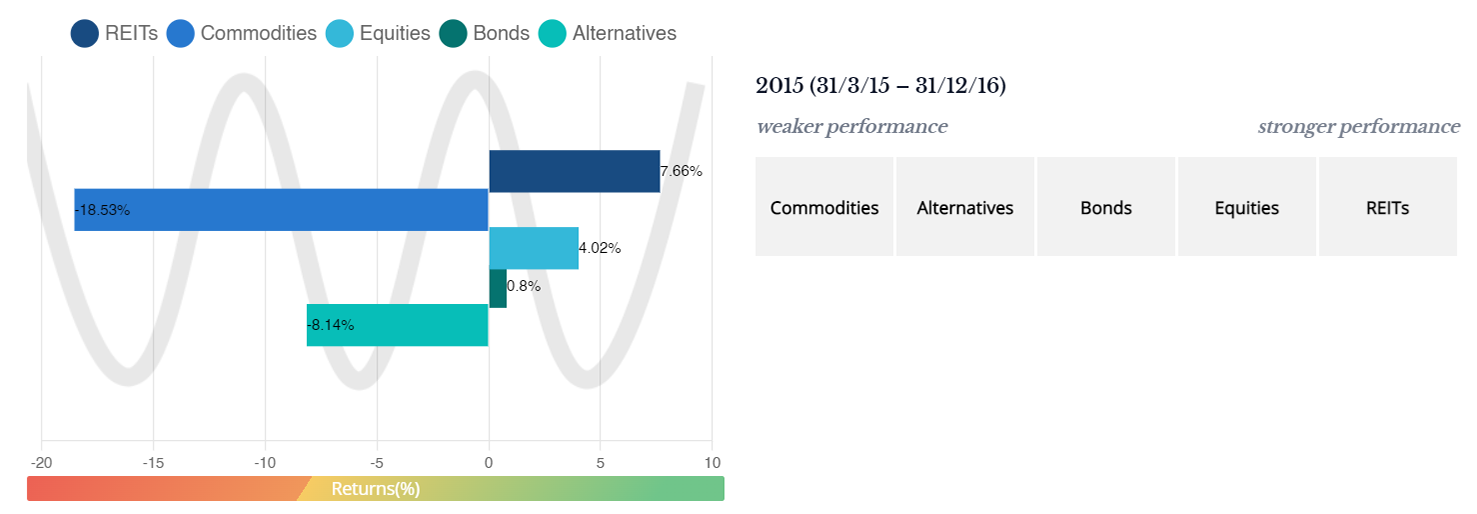

For those who find equity volatility challenging, FGOP provides wealth compounding with true diversification by investing across equity, fixed income, and alternatives.

Everyone wants to be rewarded, but not everyone can take the ups and downs that come with it. While 100% equity investing can provide higher compounding over time, its interim declines are not for everyone. Our multi-asset portfolios bring less pain during a crisis yet provide a good enough return by blending equities, bonds, and alternatives effectively.

|

Annual Returns |

Annual Volatility |

Average Drawdown |

Maximum Drawdown |

| FGO+ |

6.25% |

10.46% |

-6.02% |

-38.66% |

| Equities (100%) |

6.56% |

15.69% |

-9.60% |

-54.92% |

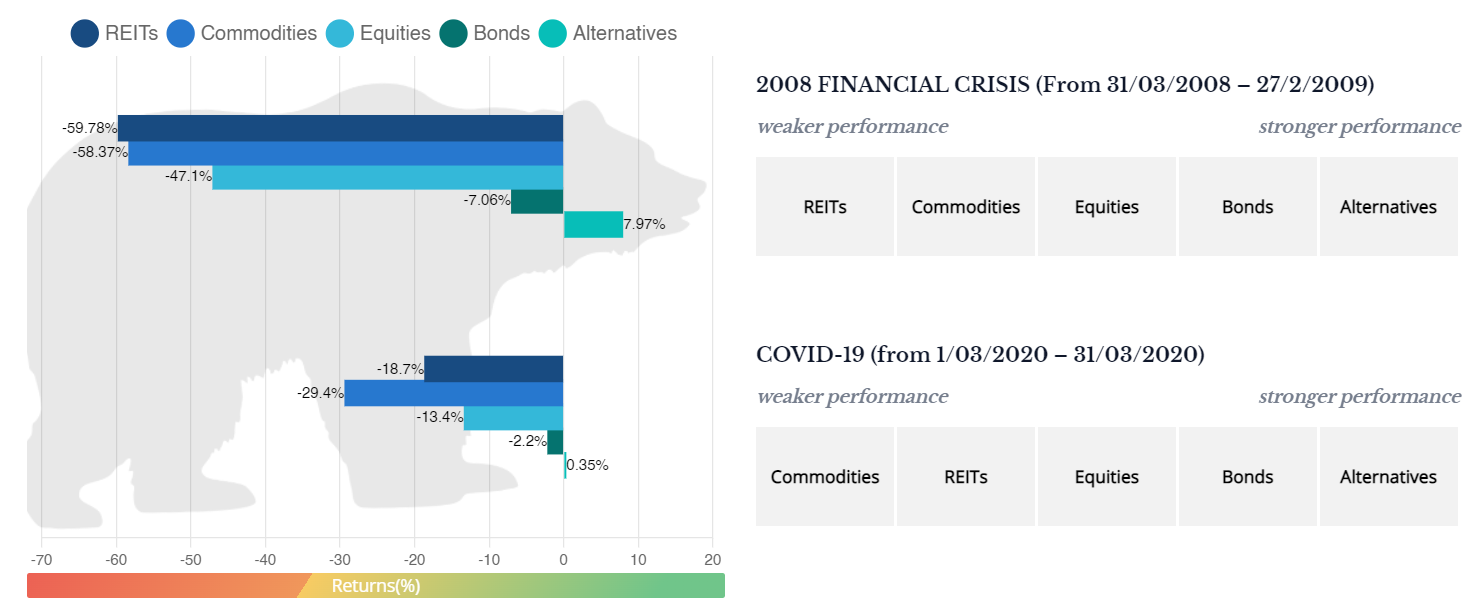

2008 FINANCIAL CRISIS

- FGO+: -38.66%

- Equities (100%): -54.92%

COVID – 19

- FGO+: -15.19%

- Equities (100%): -21.36%

Source: Finexis Asset Management and Bloomberg. Past performance is no guarantee of future results.